Worcester County Property Taxes

Anticipated General Fund Revenues. For this reassessment January 1 2020 is the legal tax or assessment date.

Bathing Beach Advisories Worcester County Maryland

NETR Online Worcester Worcester Public Records Search Worcester Records Worcester Property Tax Maryland Property Search Maryland Assessor From the Marvel Universe to DC Multiverse and Beyond we cover the greatest heroes in Print TV and Film.

Worcester county property taxes. The median property tax in Worcester County Massachusetts is 3117 per year for a home worth the median value of 282800. The tax year runs from July 1st through June 30th and billings are based on the assessments. Worcester County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Worcester County Massachusetts.

Guide to searching the database. Worcester County collects the Real Property Tax for the towns of Berlin Snow Hill Pocomoke and Ocean CityThe current Berlin town tax. Box 248 Snow Hill MD 21863.

Worcester County is the easternmost county within the state of Maryland view interactive mapOur county seat is the town of Snow Hill. Find Worcester County residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records more. Real Property Tax Worcester County MarylandReal Estate Details.

Worcester Property Taxes Real Estate. Based on the Real Property tax rate of 0845 NET property taxes. Worcester County businesspersonal property tax must be paid before obtaining clearance from the Treasurers Office.

Pursuant to Worcester County Code Section 1-208 all new businesses in Worcester County may be required to pay a refundable Personal Property Liability Fee based on the traders license cost. This means the values should represent the market value of the property based upon a theoretical sale date of January 1 2020. Payments may be made at the Office of the Treasurer or mailed to Worcester County PO.

Free Worcester County Property Records Search. THE TERMS OF USE for the SDAT website prohibit any form of automatic or robotic data collection extraction or copying such as data mining or web scraping. Worcester County collects on average 11 of a propertys assessed fair market value as property tax.

Worcester County Government Center 1 W. The Worcester County Treasurer located in Bishopville Maryland is responsible for financial transactions including issuing Worcester County tax bills collecting personal and real property tax payments. The county was named for Mary Arundel the wife of Sir John Somerset a son of Henry Somerset 1st Marquess of Worcester.

Room 1105 Snow Hill MD 21863. Worcester County has one of the highest median property taxes in the United States and is ranked 146th of the 3143 counties in order of median property taxes. Houses 3 days ago Worcester County Billing Information.

Business Personal Property Tax Worcester County Maryland. These records can include Worcester County property tax assessments and assessment challenges appraisals and income taxes. Tax payments may be made in cash or by check made payable to Worcester County.

In Massachusetts Worcester County is ranked 6th of 14 counties in Assessor Offices per capita and 6th of 14 counties in Assessor Offices per square mile. The Worcester County Treasurer and Tax Collectors Office is part of the Worcester County Finance Department that encompasses all financial. These records can include Worcester County property tax assessments and assessment challenges appraisals and income taxes.

We always look for reputable property tax lenders to add to our Worcester Countys vendor list. Worcester County residents will continue to benefit from the lowest income tax rate and the 2 nd lowest real property tax rate as compared to all other counties in Maryland. If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans for residential and commercial property owners in Worcester County Massachusetts apply to.

Violation of any Term of Use immediately terminates the users license or permission to access andor use SDATs website. The tax date or assessment valuation date is the January 1st preceding the fiscal year. A convenience fee is charged by Official Payments.

Worcester County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Worcester County Maryland. There are 39 Assessor Offices in Worcester County Massachusetts serving a population of 818249 people in an area of 1511 square milesThere is 1 Assessor Office per 20980 people and 1 Assessor Office per 38 square miles. Real Property Data Search.

The current County tax rate is 21125 per 10000 of assessed value. Annual bills are generated for County businesspersonal property tax by the Worcester County Treasurers Office.

Worcester County Property Tax Records Worcester County Property Taxes Ma

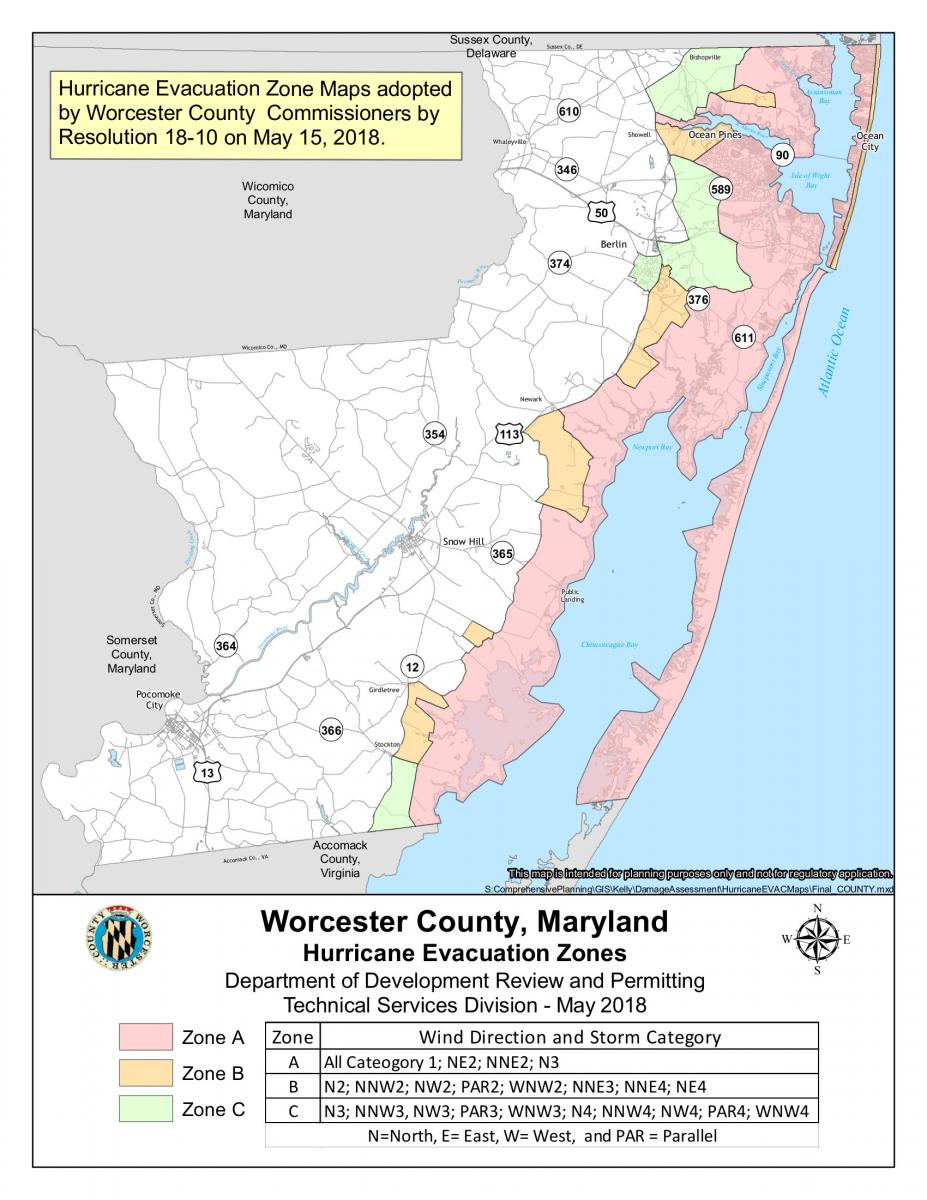

Evacuation Zones Map Worcester County Maryland

Worcester County Property Tax Records Worcester County Property Taxes Ma

Worcester County Government To Host Job Fair July 25 Worcester County Maryland

06 03 2021 Worcester S Budget Holds Steady Tax Rate Grows Spending By 6 News Ocean City Md

Post a Comment for "Worcester County Property Taxes"